Forex brokers act as intermediaries between traders and the global foreign exchange market, providing trading platforms and tools for them to execute trades efficiently as well as educational resources and customer support services.

An ideal forex broker provides traders with access to a comprehensive selection of assets at reasonable fees with outstanding customer service and should also be regulated. As traders appreciate having many choices available to them, pick a broker with many available accounts.

Platforms

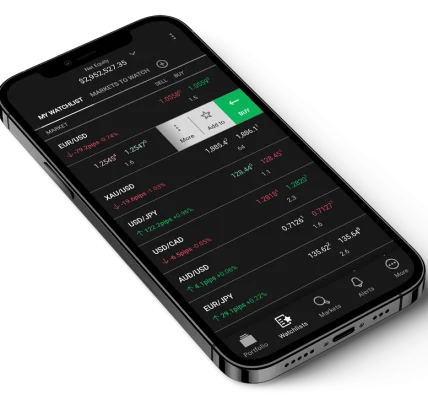

An excellent online forex broker should offer an intuitive trading platform and outstanding customer support, in addition to providing research tools, news feeds, market analysis and automated trading bots that trade based on current market information – though these bots cannot guarantee 100% profit in every instance.

A good forex broker should provide a demo account, enabling you to experience their platform before investing real money. Some brokers also offer social investing, whereby experienced traders may allow you to copy trades from them; although this can be useful as a learning tool, keep in mind that Forex trading is high-risk activity that could cause you to lose everything that was invested.

IG is another top-rated broker offering multiple trading platforms, such as web and mobile app access to global major currencies and over 550 CFD instruments, such as stocks, commodities and cryptocurrencies. Furthermore, this broker features such as an unlimited number of charts with the capability of comparing multiple time frames within one chart.

Trading conditions

Forex trading involves exchanging one currency for another on the global foreign exchange market, which is the world’s largest and most active marketplace. The best forex brokers provide traders with services such as trading platforms, educational content, market analysis and automated trading software to execute trades automatically based on relevant information.

Before opening an account with any broker, traders should carefully consider its pricing structure. Some charge commission while others employ spreads as a method of marking up buy/sell prices of assets – these spreads are commonly quoted in “pips,” representing one-tenth of a point. Furthermore, traders must understand how leverage impacts their profit and loss potential.

Some brokers require higher minimum deposits than others; US regulated brokers, for instance, must maintain at least $20 million. Meanwhile, Cyprus boasts much lower capital requirements for forex brokers compared to other locations, making it an attractive place for them to operate from.

Minimum deposit

To begin trading Forex, you will require some capital. Brokers generally require a minimum deposit in order to open an account – this varies between brokers; typically those with low minimum deposit requirements are more suitable for beginners; such brokers offer several trading platforms (MT4/MT5) along with demo trading options.

If you want to begin trading Forex, choosing a broker with low minimum deposits is the perfect place to begin. Such brokers allow traders to start off small investment amounts that help prevent substantial losses; additionally they often offer comprehensive research tools and offer competitive trading fees.

XM is a global forex and CFD broker offering Contracts for Difference (CFDs) on over 100+ trading instruments. Regulated by several top-tier regulatory authorities, its website is user-friendly, and technical support specialists are readily available to answer your queries.

Customer support

Reputable forex brokers will quickly address your queries and concerns, offering support via multiple channels such as email, live chat and phone. Furthermore, SIPC membership provides protection up to a certain limit should any losses occur during transactions.

As well as offering a secure trading environment, an excellent broker should also be transparent about their fees and services, providing educational tools and resources to aid traders’ success. Furthermore, such brokers should avoid sending unsolicited emails or cold calling potential clients as this is often employed by forex scammers.

As part of your research into potential forex brokers, it is also vitally important to establish their regulatory status with government bodies. This information should be available on their website; in the United States this includes regulators like the Commodity Futures Trading Commission and National Futures Association which monitor fraudulent brokers as well as ensure they follow US laws.